MCGI Canada Exposed: Millions Diverted Overseas in Apparent Cross-Border Laundering Scheme

- Shiela Manikis

- Jun 30, 2025

- 4 min read

By MCGI Exiters Canada | June 30, 2025

Toronto, ON - A months-long investigation into the Canadian branch of the Members Church of God International (MCGI) has uncovered a sophisticated and potentially illegal cross-border financial operation, echoing the same patterns of abuse previously documented by MCGI Exiters in MCGI Australia and the UK.

Public records obtained from CharityData.ca and corroborated by internal leaks show that over 90% of MCGI Canada’s annual expenditures from 2015 to 2023 were funneled to overseas recipients, primarily to undisclosed MCGI operations believed to be under the control of MCGI Central in Apalit, Pampanga, Philippines. Despite being a registered Canadian charity (BN: 888183811RR0001), MCGI Canada has no known charitable programs within Canada, issues no tax receipts, and reports all funds as vague “other expenditures”, a combination that suggests the use of charitable status as a cover for illicit remittance.

📉 A Pattern of Disguise, Diversion, and Decline

An analysis of MCGI Canada’s official filings reveals disturbing trends:

$843,527 of its $881,097 total expenses in 2021 were sent overseas.

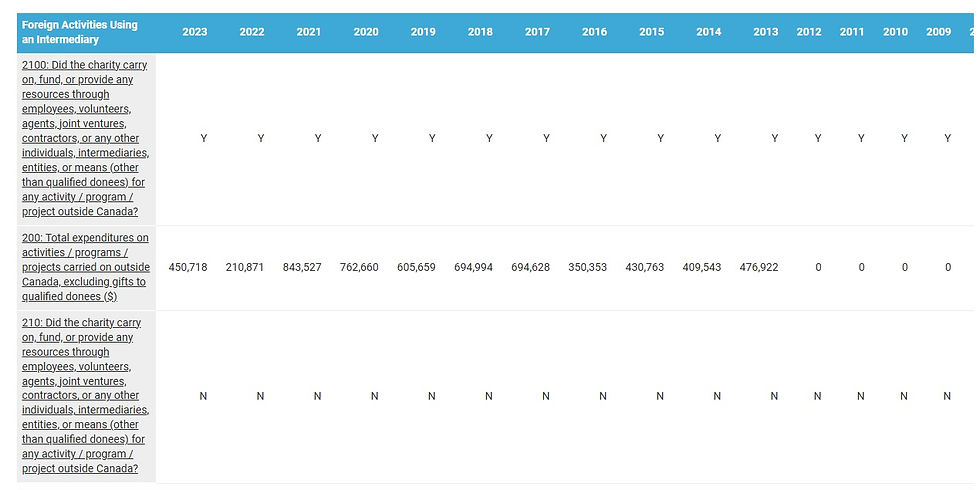

From 2015 to 2023, the vast majority of its expenditures (over $6 million CAD) left the country, without the use of any declared intermediaries or contractors, a direct violation of Canada Revenue Agency (CRA) policy requiring “direction and control” over foreign projects.

The organization claimed $0 in tax-receipted donations every single year, while continuing to collect vast sums thereby raising questions about the source and documentation of funds.

Even more alarming is the precipitous financial crash that began in 2021, the year Daniel Razon officially assumed de facto control of MCGI operations:

Year | Reported Revenue | % Drop from 2020 |

2020 | $891,573 | – |

2021 | $813,716 | ↓ 9% |

2022 | $222,018 | ↓ 75% |

2023 | $512,710 | ↓ 42% (vs. 2020) |

This represents a revenue collapse of over 50–60% in just two years.

The cause? That’s where the debate splits.

Some argue the reported decline is deliberate understatement, a strategy to minimize regulatory attention during ongoing overseas transfers. Others, especially former insiders, see the figures as a genuine reflection of mass member attrition, following widespread dissatisfaction with Daniel Razon’s shift in leadership style, alleged doctrinal tampering, and increasing commercialization of church programs.

“Members began quietly exiting. Consultations were silenced, finances went opaque, and Kuya Daniel Razon made it all about him. The donations dried up,” shared a former finance volunteer based in Saskatoon.

🔓 Inside the Machine: Leaked Message Shows Informal Transfers

Internal communications support these suspicions. A leaked message from a regional officer, “Bro. Jurany,” instructs members in Canada to send their “voluntary contributions” via Interac e-transfer to a personal Gmail-linked account (financemcgisaskatoon@gmail.com). Members are told to simply label their payment (e.g., “WS $500”)—with no mention of formal acknowledgment, receipt issuance, or compliance with CRA donation reporting requirements.

This sidesteps not just standard nonprofit accounting procedures, it potentially obscures hundreds of thousands in unreported income.

🌍 Australia, UK, and Now MCGI Canada: A Global Funnel?

This isn’t the first time MCGI has faced such scrutiny.

In Australia, whistleblower reports revealed hundreds of thousands in "charity funds" routed to Philippine bank accounts associated with high-ranking ministers, alongside evidence of inflated housing and luxury travel expenses.

In the UK, filings from MCGI’s registered charity (1120310) showed large outbound foreign transfers, questionable "support costs," and nearly identical patterns of zero intermediaries, zero domestic programs, and near-total foreign remittances.

Canada appears to be replicating this scheme.

All three jurisdictions exhibit the same laundering model:

Heavy inflow of unreceipted “donations,”

Disguised foreign transfers labeled as religious aid,

No traceable program implementation, and

Control rooted in Apalit, Philippines—home of MCGI Central.

🛑 Where the Money Goes: Politics and Paramilitary Operations

What happens to the millions sent overseas?

Investigative reports suggest that these funds support:

Ill-gotten Brazil and Philippine Mansions owned by Kuya Daniel Razon;

KDRAC, a 2.5 Billion Peso 70-hectare private armed training camp for Kuya Daniel Razon's personal close-in security;

And massive infrastructure projects whose ownership and profit structures remain undisclosed.

Such activities are not considered charitable purposes under Canadian law. Political activity, especially partisan coordination and support of violence, is strictly prohibited for charities.

📣 Exiters Take Action

In response, the MCGI Exiters network has launched a coordinated legal and regulatory campaign.

A detailed submission has been sent to the CRA’s Offshore Tax Informant Program (OTIP) outlining the evidence of:

False declarations on the use of intermediaries,

Systematic unreceipted donations,

Diversion of funds for non-charitable purposes,

And alignment with known laundering frameworks observed in Australia and the UK.

Additional reports have been or will be submitted to:

FINTRAC, for violations under Canada’s money laundering and terrorist financing laws,

The RCMP Financial Crimes Division,

And Canadian media outlets and MPs tracking charity abuse.

“This is an empire laundering faith into cash,” one organizer said. “Our mission isn’t just religious recovery—it’s financial justice.”

⚖️ What CRA Must Now Investigate

Are MCGI Canada’s foreign remittances traceable to legitimate charitable activities?

Why are there no intermediaries declared despite repeated overseas operations?

Who controls the Gmail-linked donation accounts, and where are those funds truly going?

Is the 50–60% crash in reported revenue a symptom of manipulation or revolt?

If CRA finds that MCGI Canada is operating in violation of its charitable obligations, it may revoke its status, impose tax penalties, and refer criminal components to law enforcement.